If financial market participants disclose how and to what extent the financial products that are made available as environmentally sustainable invest in activities that meet the criteria for environmentally sustainable economic activities under this Regulation and if financial market participants use common criteria for such disclosures across the Union that would help. The good news is just like the Pareto principle only a handful of news releases are responsible for the bulk of the price movement for most currency pairs.

Principles Of Financial Management The Media Vine Financial Management Management Financial

Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches.

. The research method which used the strategy to control the situation is called the explanatory case based research method. Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements. The primary goal of corporate finance is to maximize or increase shareholder value.

It describes the users and uses of accounting and also describes accounting as a process. We will first cover basic concepts of accounting including cost accounting. A change in the valuation technique or model used to meet the fair value measurement objective would not be considered a change in accounting principle.

These type of case based research methods focused on the phenomena in the context of the case situations such as an investigation which are based on the reasons of global financial crises occurred in the year 2008 to 2010. Just as the EDGAR system used by the SEC stores data for retrieval an AIS must provide a way to store and retrieve data. Anecdotal evidence and research means we now know that this paradigm is insufficient to describe real financial markets.

Log in with Facebook Log in with Google. In the past the field of finance developed a successful paradigm based on the assumption that investors and managers are rational and that the market is efficient. This course adds institutional social cognitive and.

Determine the Efficiency of. Before computers were widely used financial data was stored on paper like the journal and ledger shown in Figure 75. This guide will teach you to perform financial.

Describe Accounting as a process LEARNING OUTCOMES In this chapter we discuss accounting and its importance. Click here to sign up. Close Log In.

DCF analysis comparable companies and precedent transactions. As such a company would not be required to file a preferability letter from its independent accountants as described in Rule 10-01b6 of Regulation S-X when it changes valuation techniques or models. Chapter 2 describes the features of different types of organisa-tions.

F9 Financial Management Question Bank. Remember me on this computer. It explains the role of technology in the accounting process.

Log in with Facebook Log in with Google. Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements. Click here to sign up.

Determine the Efficiency of. A utilitarian approach considers all stakeholders and both the long- and short-term effects of a business decision. Remember me on this computer.

Some of these news events are common for almost all currencies and if you can just understand how these affect your favorite currency pair then you will be far ahead as a trader than most novice traders who are. 3 Credits Financial Analysis for Technology Managers MG-GY6033 The course will focus upon accounting issues as well as financing and investment functionsdecisions of the financial manager as applied to practical real world situations. Enter the email address you signed up with and well email you a reset link.

Financial statements are used to understand the financial performance of companies and to make long- and short-term decisions. Enter the email address you signed up with and well email you a reset link. Advanced Financial Management Class Notes.

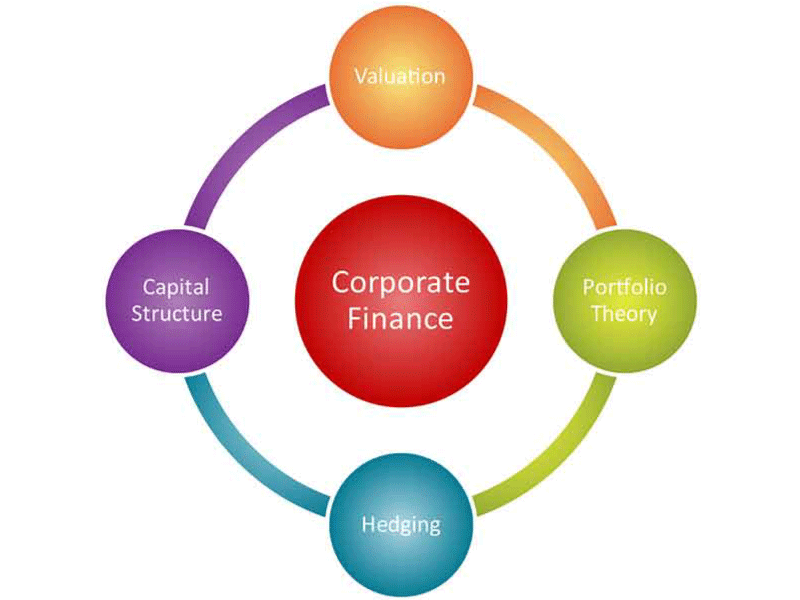

Data can be stored by an AIS in paper digital or cloud formats. As well as basic concepts of finance. Corporate finance is the area of finance that deals with sources of funding the capital structure of corporations the actions that managers take to increase the value of the firm to the shareholders and the tools and analysis used to allocate financial resources.

Log In Sign Up. Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions. Financial Statement Analysis Analysis of Financial Statements How to perform Analysis of Financial Statements.

This allows corporate decision makers to choose business actions with the potential to produce the best outcomes for the majority of all. 2 Principles of Accounts The Business Operating. Log In Sign Up.

Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches. Access the answers to hundreds of Stock valuation questions that. Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions.

Get help with your Stock valuation homework. Close Log In. Valuation Methods Valuation Methods When valuing a company as a going concern there are three main valuation methods used.

Stock Valuation Questions and Answers.

Financial Investment Valuation Models Pacific Crest Group

Valuation Concepts 5 Most Important Valuation Concepts

Valuation Principles List Of Most Important Valuation Concepts

0 Comments